Black-Scholes-Merton Calculators, Designed for Simplicity & Precision,

Quantify and Control Your Risk:Reward

Elevate your trading game from guesswork to informed, calculated decisions. Master options trading with insights gained on this site, from fundamentals to advanced strategies designed to give you a true competitive edge. My Options Trading Calculators are intuitive enough for beginners yet robust enough to meet the demands of experienced professional traders.

Say goodbye to complicated spreadsheets and feature-heavy software that only slows you down. These calculators are streamlined, user-friendly, and thoroughly documented for easy use and support. Developed in 2022, they've earned consistently positive feedback from traders at all levels. Four different BSM Calculators are listed below — please find more detailed images using the links here or clicking on "Products" in the menu). Note: All Calculators are unlocked allowing you to edit or customise them.

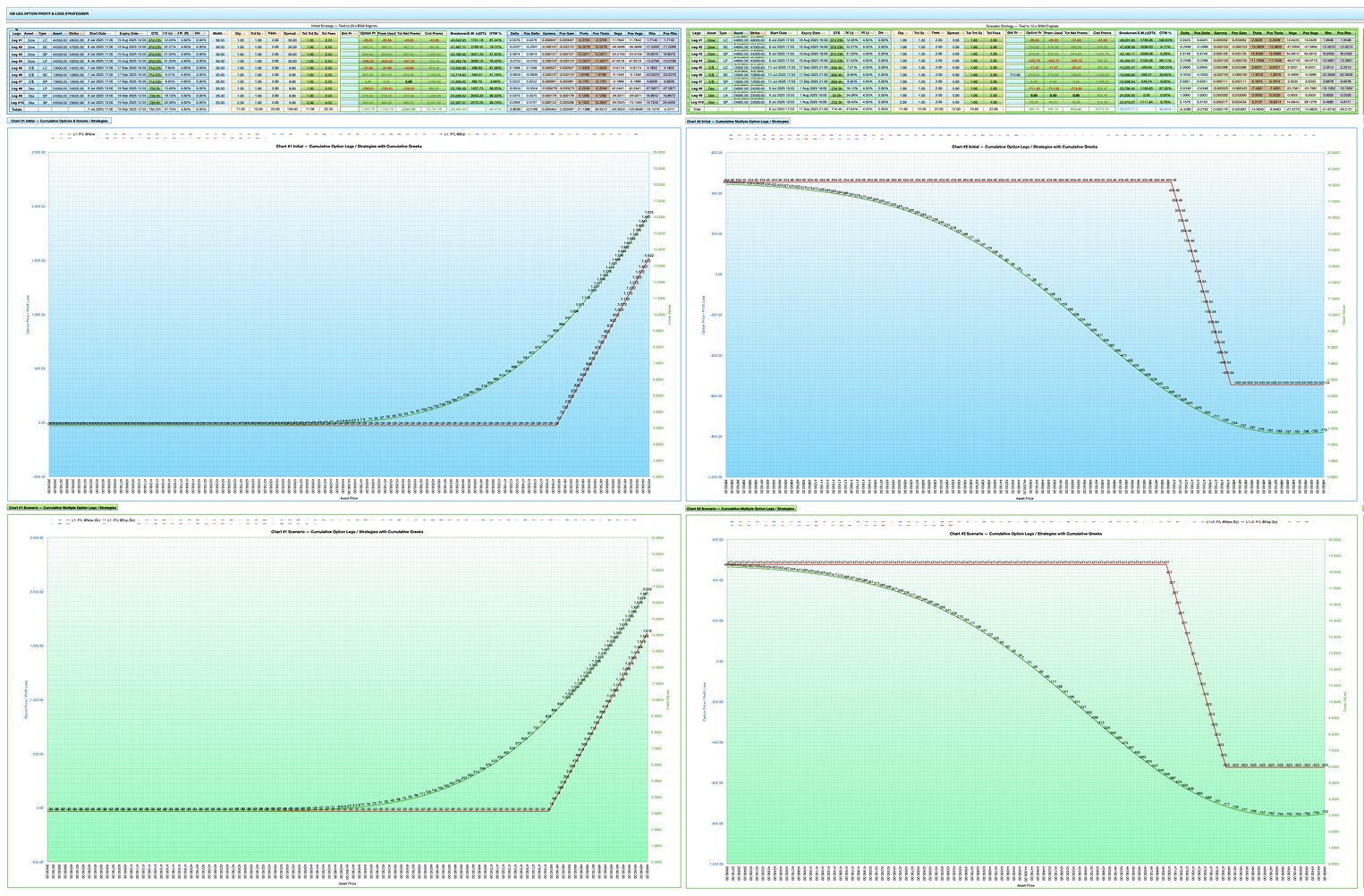

The World's First Professional Black-Scholes-Merton 10x Leg Option P/L

Master Strategiser (Apple Numbers Desktop Spreadsheet)

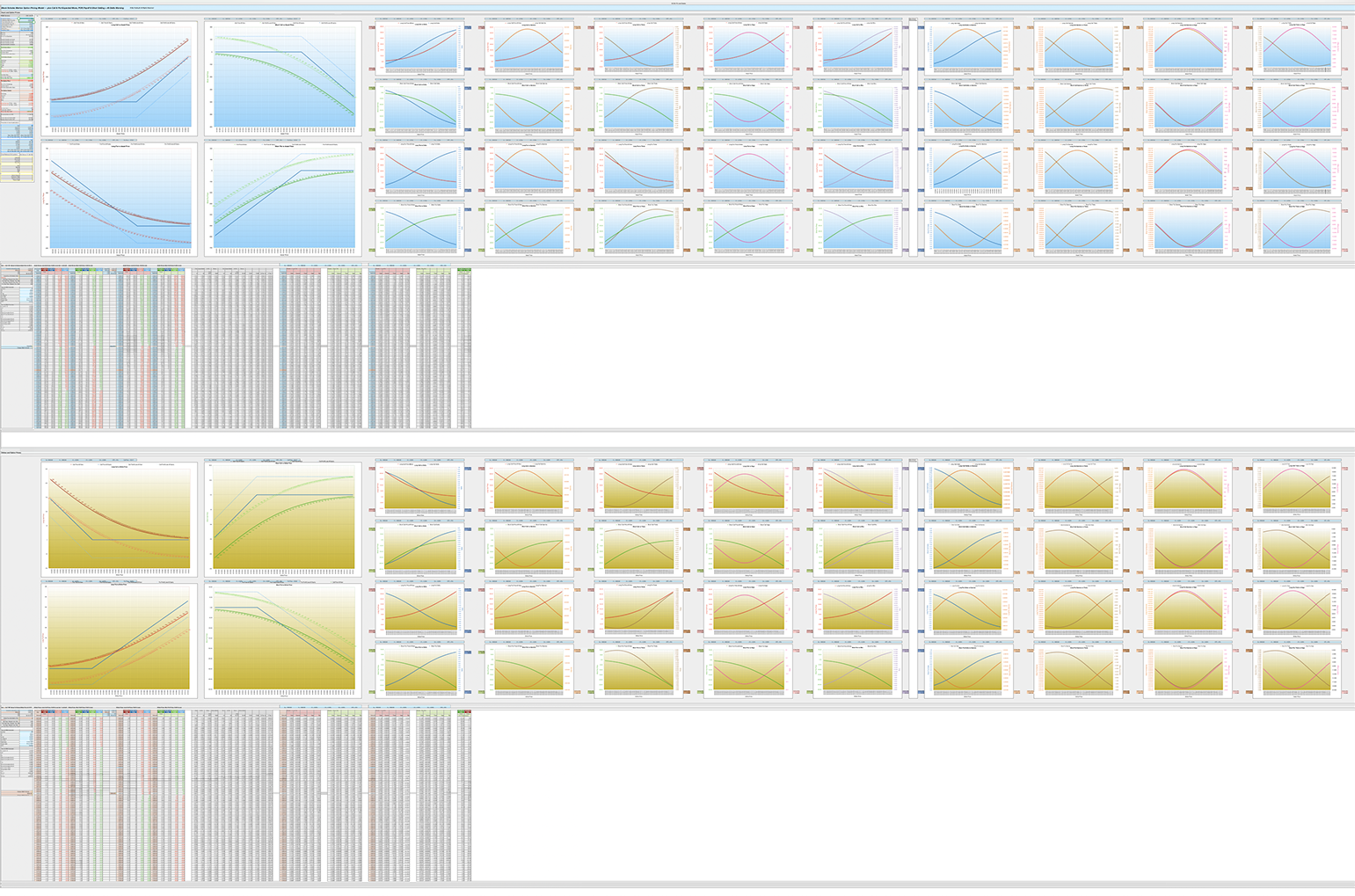

Welcome to the home of the 10x Leg Option Profit & Loss Master Strategiser Calculator, a tool I built to fill a crucial gap in Options Trading analysis. As an active trader, I found that existing solutions fell short when it came to managing complex strategies and modelling future "What If" Scenarios involving multiple option legs and positions. That's why I created this calculator — the first of its kind to simultaneously track Profit & Loss for up to 10 option legs or underlying hedges.

You can dive deep into your trading strategies with unprecedented precision and accurately model "What-If" scenarios. Make the changes in the separate green bordered table, from those "Initial" BSM inputs entered in the top blue bordered table. 20x independent Black-Scholes-Merton (BSM) engines precisely calculate Option Prices, Greeks and P/L.

For more details on the 10x Leg Option P/L Master Strategiser (in Apple Numbers) Click Here.

The blue charts show your Initial Positions and the green charts plot Scenarios. Charts come with advanced charting capabilities for both single positions and cumulative strategies. Drop-down menus allow for rapid plotting of real-time and expiry-based P&L, giving you the clarity you need to make informed decisions quickly. I designed this tool to be more than just a calculator — it's a strategic asset. You'll get full Greek analysis, comprehensive Risk Metrics and a separate sheet with 30x BSM calculators, the top 20 displaying current Legs, the bottom 10 to price Options with confidence.

NOTE: All my calculators come with full detailed Instructions and also Comments (see yellow triangles in the top of some cells), explaining every aspect from simple definitions to complex descriptions of the dynamics between different Greeks. All sheets are unlocked and customisable.

Overview of BSM 10x Leg Option P/L Master Strategiser with Greeks (Higher resolution images can be found in the Product Pages)

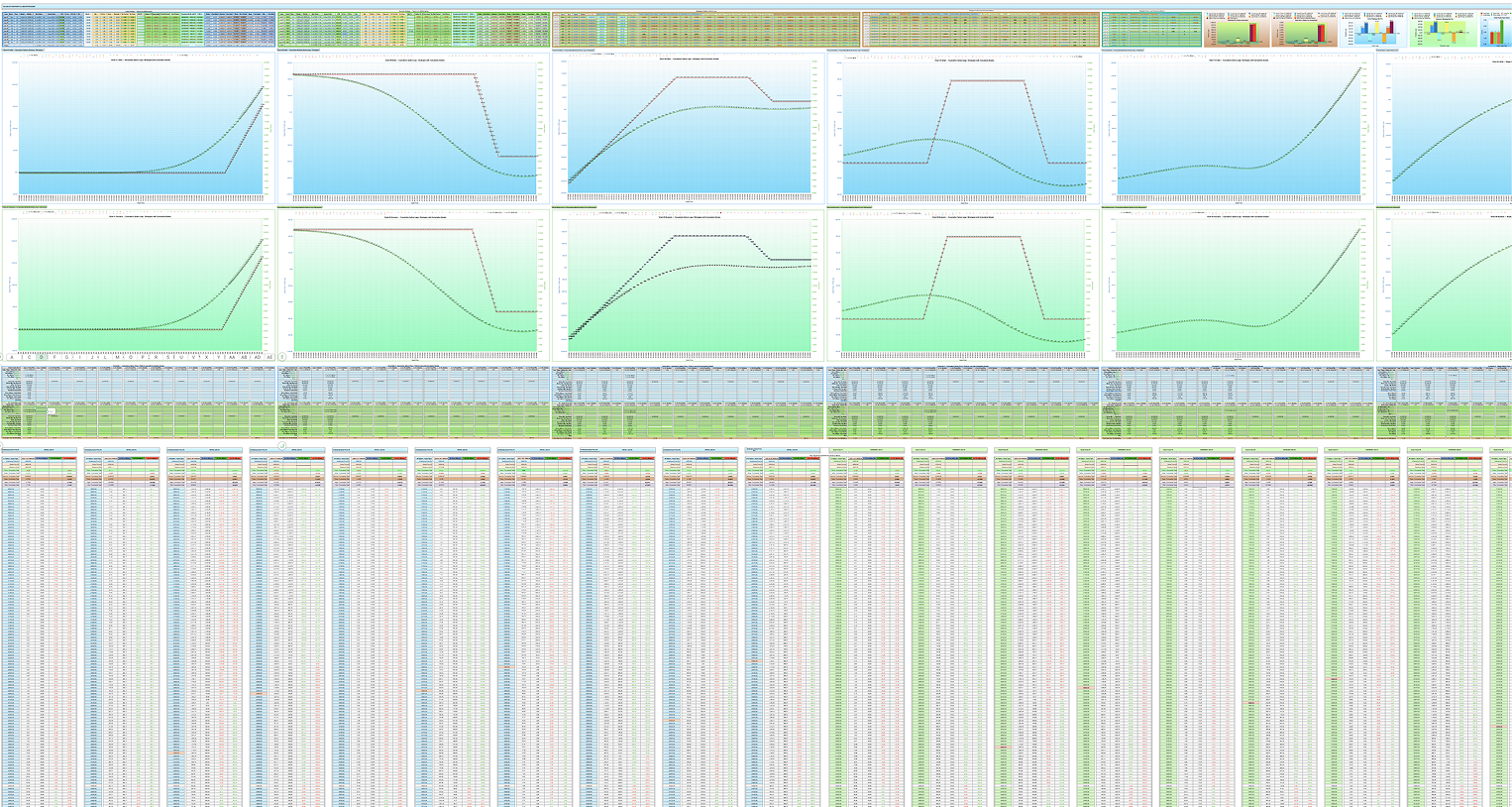

BSM Option Pricer Calculator (x8 Large Charts & x72 Greeks Charts)

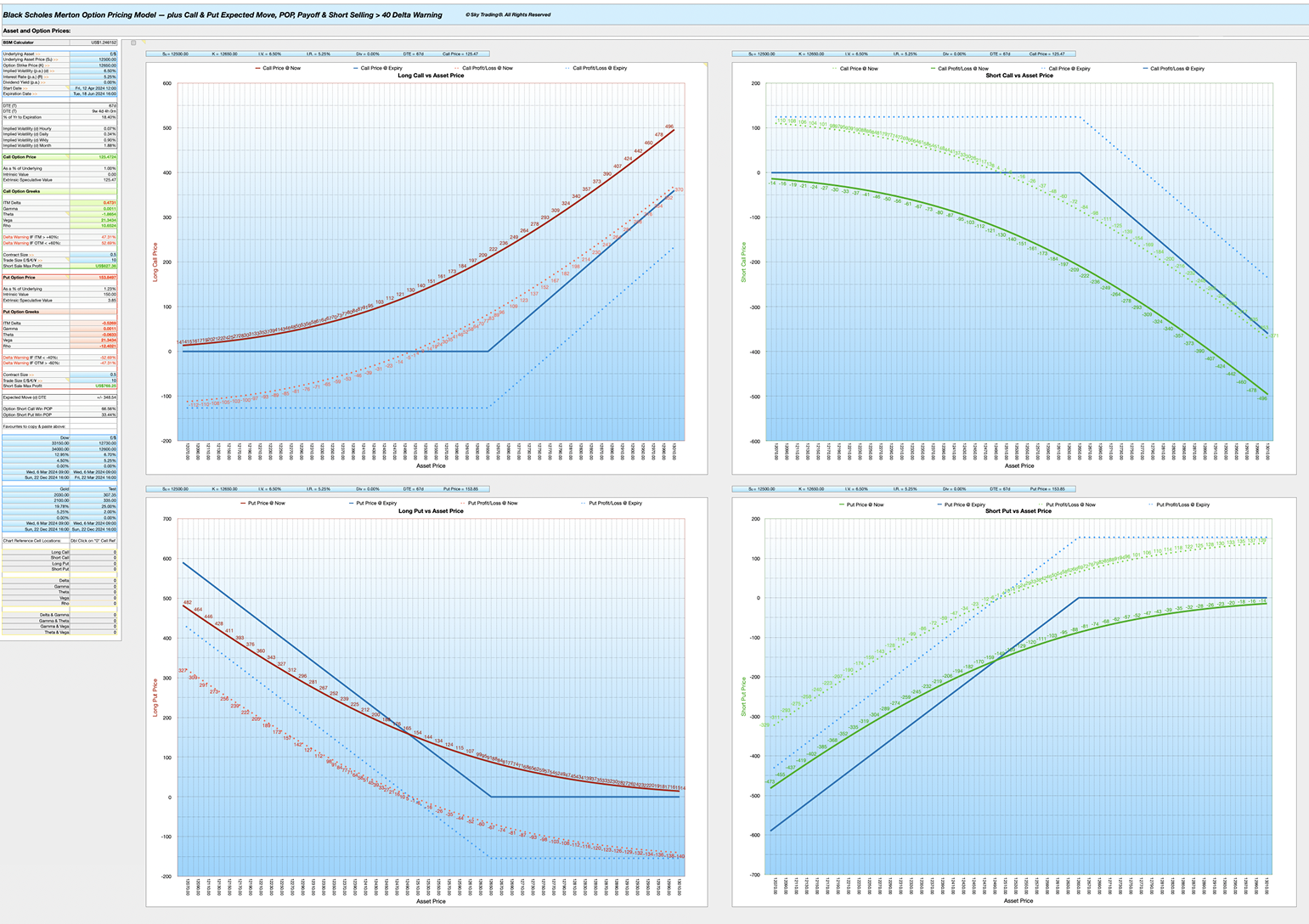

Welcome to the Advanced Black-Scholes-Merton (BSM) Options Pricer Calculator, designed to give traders the power to control risk with precision and confidence. This unique option pricing tool helps you make informed decisions by providing real-time insights into Profit & Loss, Delta probabilities, Gamma risk, and key metrics like Theta and Vega for option short sellers. With intuitive spreadsheet charting available in both Apple Numbers and Excel, you'll be equipped to manage your full risk exposure across a wide range of asset prices.

Whether you're navigating complex market conditions or looking to fine-tune your strategy, this calculator offers both beginner-friendly simplicity and the advanced features experienced traders need. Available with two BSM calculators — the large pale blue charts for plotting Asset Prices (x-axis) and gold charts for targeting Premiums using different Strike Prices (x-axis) — this powerful tool will help you take control of your risk.

For more details on the Black Scholes Merton Option Pricer (in Excel and Apple Numbers) Click Here.

The BSM calculator features charting for Long and Short Calls and Puts, displaying @Now (live) and @Expiry pricing and Profit & Loss data along with 72 Greek charts for a deep dive into Delta, Gamma, Theta, Vega, and Rho. It also offers precise option pricing, implied volatility projections, and Probability of Profit (POP) calculations to ensure you're always trading with the odds on your side.

The Calculator allows traders to calculate Premiums from 0DTE (0 Days to Expiry), 1DTE, 2DTE etc, as well as Weekly, Monthly and Yearly Expiries and longer. It includes Expected Market Move calculations for whatever time period it's set to, all the way down to the final minutes before expiry. Work out Expected Moves from an Hourly to Yearly basis giving 68.2%, 95.4%, 99.7% Confidence Levels.

Designed for traders who need speed, accuracy and ease of use, the BSM with Dividends Option Calculator is perfect for pricing, assessing risk, and staying ahead of market moves. Download it today and take control of your options trading strategy!

Overview of BSM Option Pricer w. Greeks. (Higher resolution images can be found in the Product Pages)

Overview of BSM Option Pricer with Greeks. (Higher resolution images can be found in the Product Pages)

BSM Option Pricing Calculators (30x Banks)

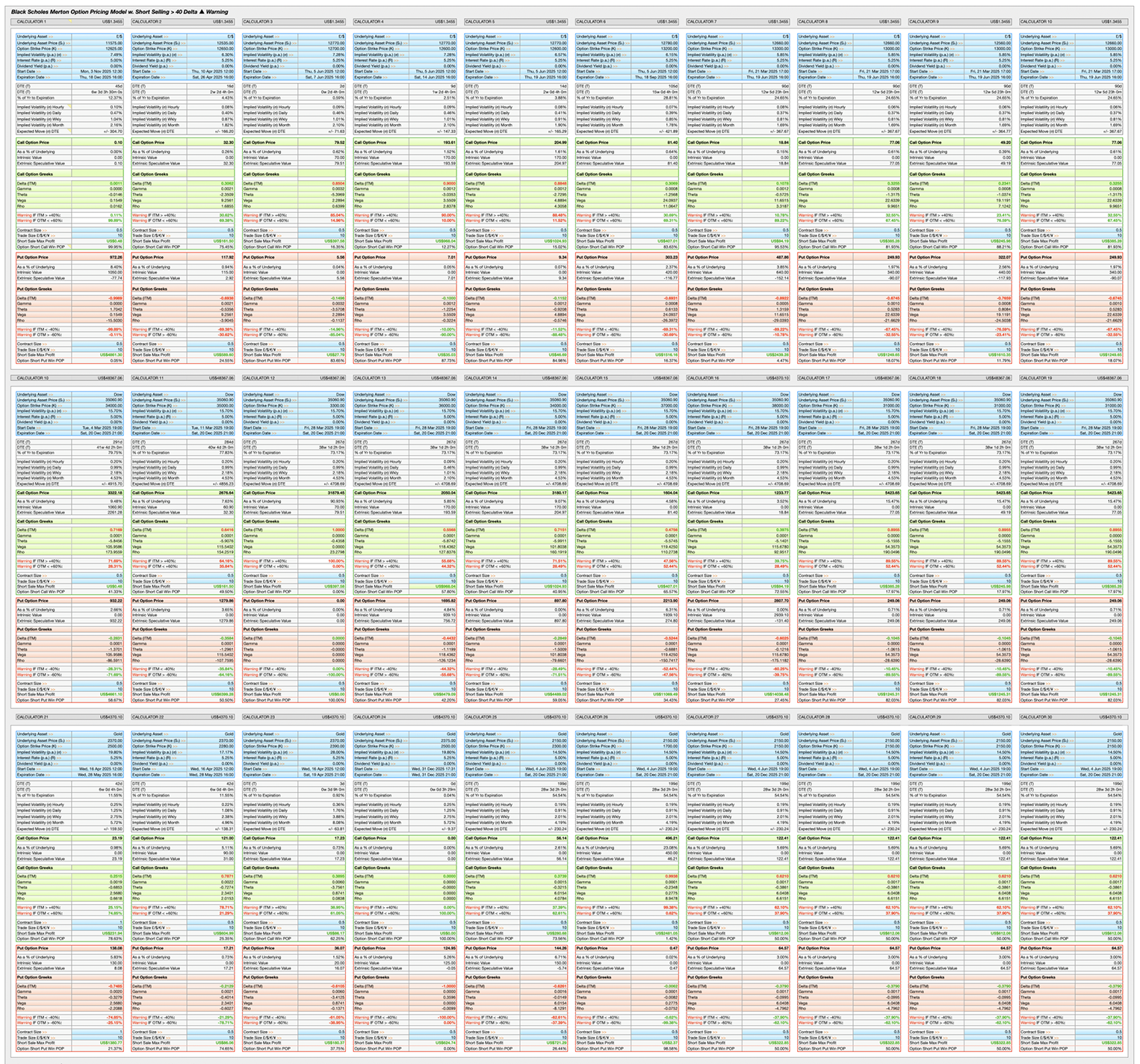

Introducing the Black-Scholes-Merton (with Dividends) Option Pricing Calculator Banks, a powerful toolset designed to give traders precise control over market risk. This comprehensive Numbers and Excel-based calculator set includes 60 individual BSM calculators (in Numbers) and 48 BSM calculators (in Excel) across two visually distinct themes — Light and Dark Blue — allowing you to choose the interface that best suits your preferences.

Key Features Recap: Accurate Option Pricing to 2 decimal places, enabling you to verify whether your broker is under or overpricing options. Implied Volatility Projections for hourly, daily, weekly, and monthly market moves, offering a complete view of potential price swings. 0DTE Capabilities: Calculate option premiums right down to the last minutes before expiry for real-time decision-making. Expected Market Move: Estimate how much an asset is likely to move over any given timeframe, from minutes to months, based on probabilities of 68.2%, 95.4%, and 99.7%.

Live @Now Pricing: Set option start dates to the current moment to monitor real-time price changes. Delta Warning: Get a red alert when OTM Delta falls below 60%, helping short sellers stay on top of risk. Multi-Bank System: Each Numbers sheet includes 30 calculators (3 rows of 10), each Excel sheet includes 24 calculators (3 rows of 8) minimising repetitive data entry and enabling quick analysis across multiple assets for a range of different DTE's.

Designed for traders who need speed, accuracy and ease of use, the BSM with Dividends Option Calculator is perfect for pricing, assessing risk, and staying ahead of market moves. Download it today and take control of your options trading strategy!

Overview of BSM 10x3 Calculator with Greeks Data (light blue version). (Higher resolution images can be found in the Product Pages)

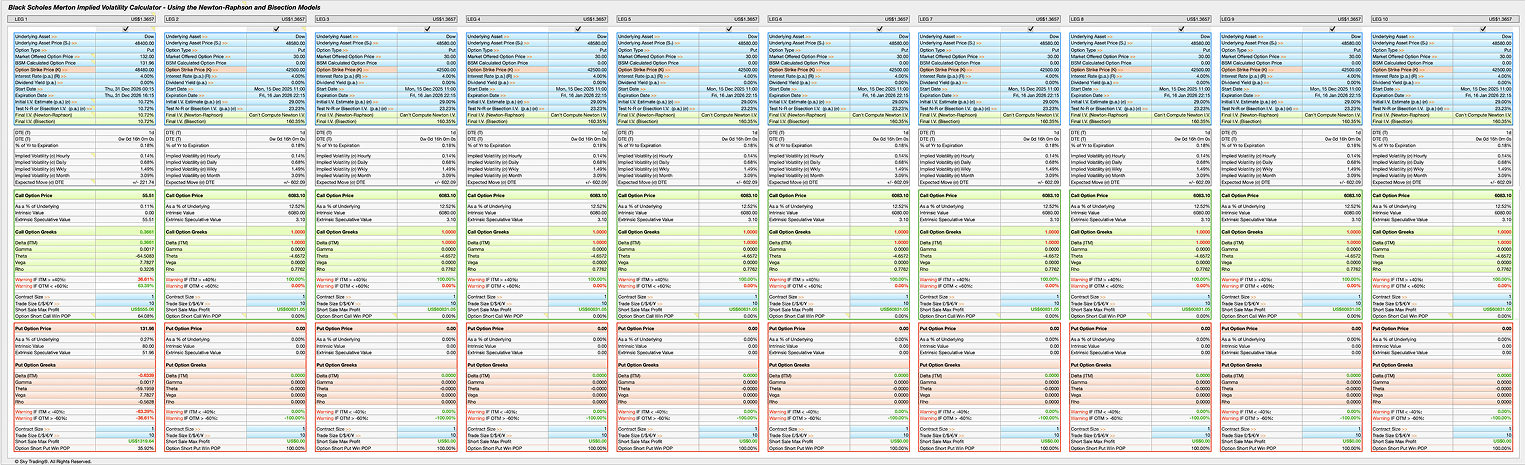

Implied Volatility Calculator (Newton-Raphson & Bisection) x10 Banks

The Black-Scholes-Merton (with Dividends) Implied Volatility Pricing Calculator calculates the Implied Volatility percentage given the set BSM inputs. The I.V. calculator set includes 10 individual BSM calculators (in Numbers) and uses two robust methods — the Newton-Raphson and Bisection models to derive the Implied Volatility percentage. Implied Volatility is not a forward-looking scenario input. It is a backed-out parameter from an Option price that already exists in the market.

Key Features Recap: Accurate Implied Volatility Pricing to 2 decimal places, using two mathematical solutions: The Newton-Raphson and Bisection models. In the event that the Newton-Raphson model fails to derive the Implied Volatility, the calculator uses a second calculation method — the Bisection model — to find the given Implied Volatility. 0DTE Capabilities: Calculate I.V. right down to the last minutes before expiry for real-time decision-making.

The I.V. percentage result answers this question: "Given today's Spot (S), Strike (K), Time (DTE), Interest Rates — What volatility must the market be implying in order to justify the observed Option price?" It does not answer: "What Implied Volatility will occur if the Spot moves to X?"

Purpose / Use: Comparing Option prices, find Option mis-pricing and Volatility surface analysis. Input: The Option Price and other typical BSM Inputs like Spot (S), Strike (K) and Start and Expiry Dates. Output: Implied Volatility (I.V.).

For more details on the Black Scholes Merton Implied Volatility Calculator Click Here.

Overview of BSM Implied Volatility Calculator with x10 Banks. (Higher resolution images can be found in the Product Pages)